Automobile pricing has hit an inflection point. For years, manufacturers have continued to push their vehicles further upscale (because consumers keep enabling them).

Cox Automotive wrote that the average car price in September 2025 was $50,080. Jalopnik just reported this month that nearly 30% of automobile trade-ins are “underwater” (meaning they owe more than the car is worth).

It’s easy to see the financial danger this poses to the American consumer. Wages have largely stagnated and there’s a lot of conflicting information on the job market.

Plus, home prices remain high. Realtor.com recently posted bleak stats about housing costs. For home ownership prices to return to 2019 levels, median incomes would need to rise 56%, home prices would need to fall 35%, or interest rates would need to drop to 2.65% (link to article).

Gas prices have dropped in many parts of the country and grocery cost increases seem to have become less drastic. But, does it matter if gasoline costs $0.50 less per gallon when the vehicle it’s powering costs $1,000 per month?

High Automobile Prices Limit Job Options

This creates a larger problem when it comes to career mobility.

Let’s say a person is looking for a new job. Their earlier position was work-from-home or a hybrid job. They own an older vehicle that is paid off but requires regular repairs to meet their transportation needs. Perhaps they even share a vehicle with their spouse.

Now, they’re looking to pivot themselves into a new job. Many employers are returning to fully in-office policies.

Suddenly, that older paid off vehicle may not be dependable enough for daily commuting in rush hour traffic and a new car is needed.

Factoring Higher Transportation Costs Into A Budget

If the job seeker buys a new car with a monthly payment of $700 per month, they need to factor an additional $8,400 into their budget (before gas, insurance, registration, and maintenance costs).

A used car could work, but, at $500 per month, which would still be $6,000 per year and the vehicle will probably have slightly higher maintenance costs.

Destroying Your Finances to Impress Strangers

The numbers get worse for those looking at more expensive vehicles.

As of this article, Jeep is advertising financing for 72 months at 6.9% APR on the popular (and expensive) Wrangler model.

The cheapest Wrangler shown in their inventory near me is $38,060.

If a buyer places 20% down, which is about $7,600, that payment would be around $517.85. The total interest over the life of that loan would be about $6,825.30. So, that $38,060 Jeep would cost $44,885.30.

How Can I Limit The Financial Burden of Transportation in 2026?

So, what’s the solution? That depends on your situation.

- Moving closer to work can help bring transportation costs down. This is much easier for renters. It’s also more drastic for most people.

- Ensure that a budget with a new job factors higher transportation costs.

- Consider options like public transportation.

- Maintain your current vehicle. Fixing things early can prevent more catastrophic repairs.

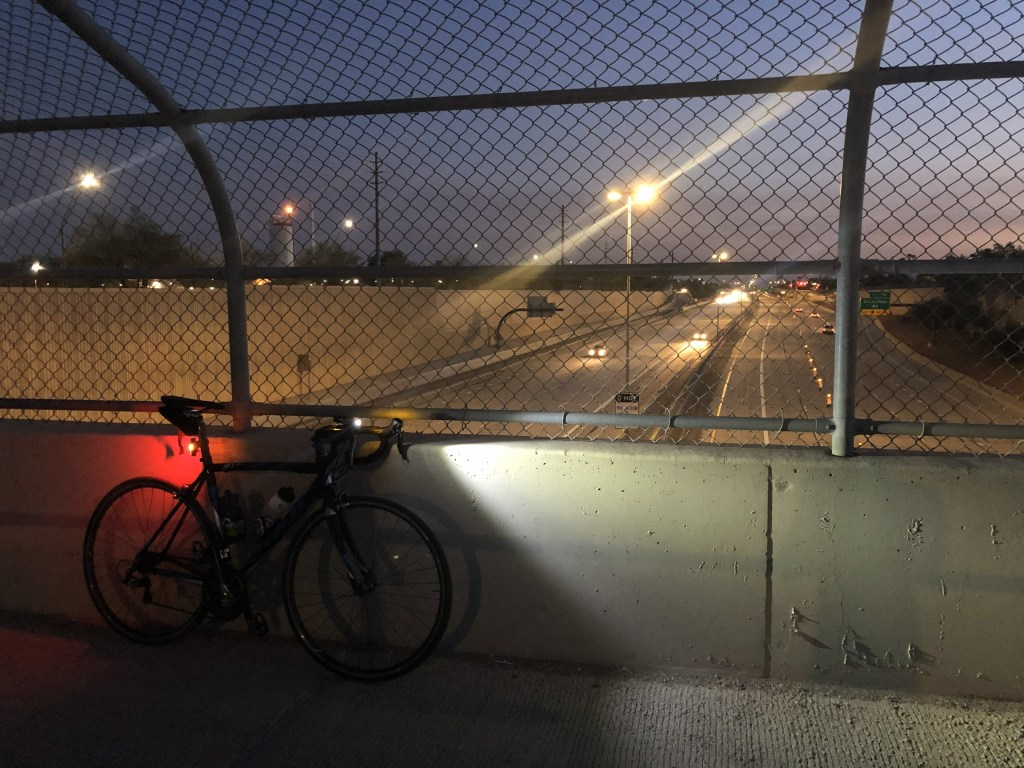

- Replacing some car trips with trips by bicycle can help reduce wear-and-tear on your vehicle. This might not be possible for daily commuting to work, but those short 1-mile errands on the weekend are particularly hard on your car.