Over the past few months, I’ve been evaluating my relationship with automobiles.

We started camping as way to affordably see the American West during the pandemic. Our XC70 has allowed us to explore dirt roads, carry our gear, and navigate treacherous winter storms.

The trendy term is “overlanding”, but it’s just car camping.

I’ve watched the automotive industry evolve over the same time period. Off-road worthy vehicles have gotten continuously more capable in just five years. They have also become more expensive, more complicated, and more ostentatious.

It’s just not for me.

I have other interests and priorities beyond cars.

I plan to keep our Volvo (which we’ve named “Meatball”) on the road as long as possible. However, when the time comes for its’ replacement, I’m not spending the money required for another vehicle capable of carrying our rooftop tent. I’ll just sell the tent.

The Opportunity Cost of a New Vehicle

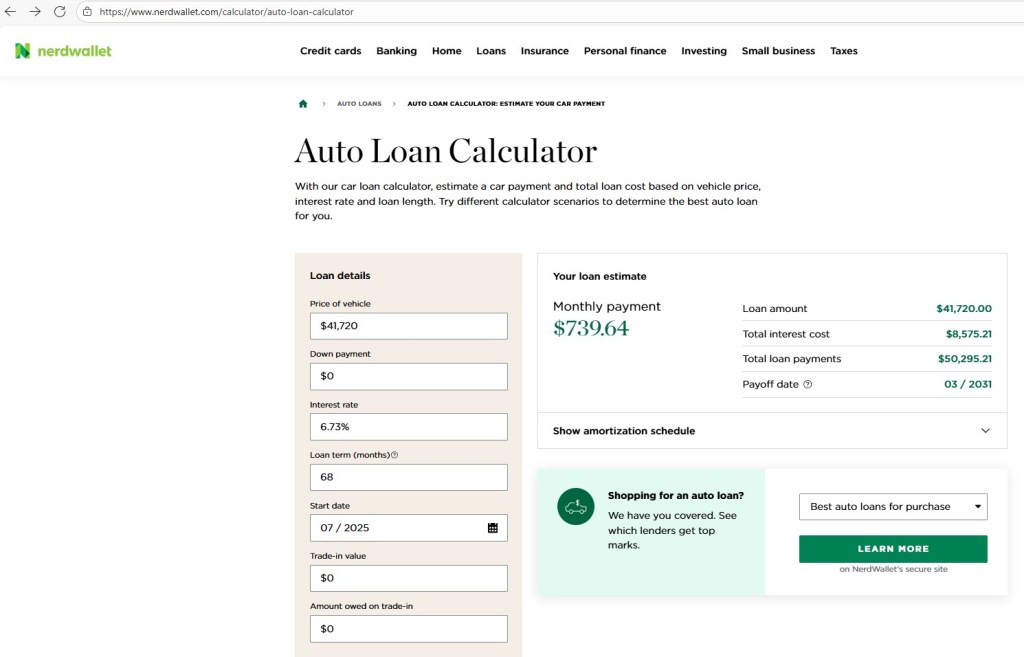

According to Experian, the average new car buyer is spending $745 per month to finance $41,720 for 68.63 months at 6.73% interest (Link to Article). That means the average new car buyer could be spending $8,940 per year for just payments. That doesn’t even include fuel expenses, registration costs, or insurance.

Over the life of the loan, this could be an approximate total of $8,575 in interest alone!

While people may be able to “afford” these payments, it’s important to look at the opportunity cost. What are you sacrificing for this depreciating asset? How else could this money be used as a tool?

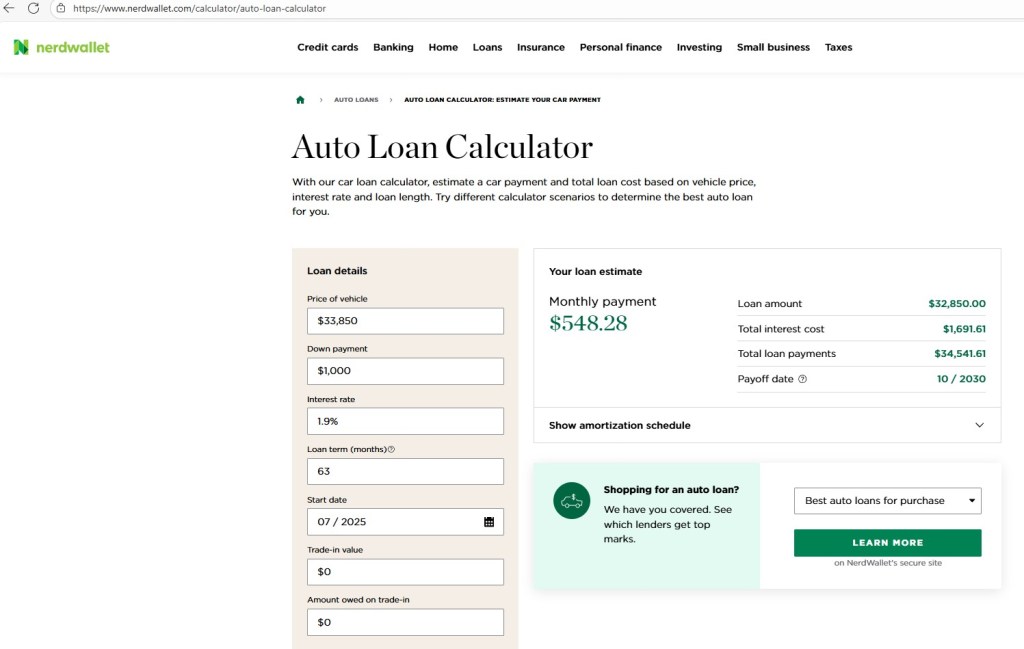

I checked the US News website to see the best automotive deals this month (US News Website: Best Car Deals). According to their website, Subaru is currently showing 1.9% interest through tomorrow on the Crosstrek for 63 months. Subaru shows it applies to select trims, including the Sport. The closest dealership to me shows multiple vehicles in this Sport trim for $33,850.

Using these figures as a hypothetical, along with a $1,000 downpayment, I estimated an average car payment of $548.28. The best part? The total interest cost of this would be $1,691.61.

That is a savings of 81% in interest over the life of the loan compared to the current Experian average!

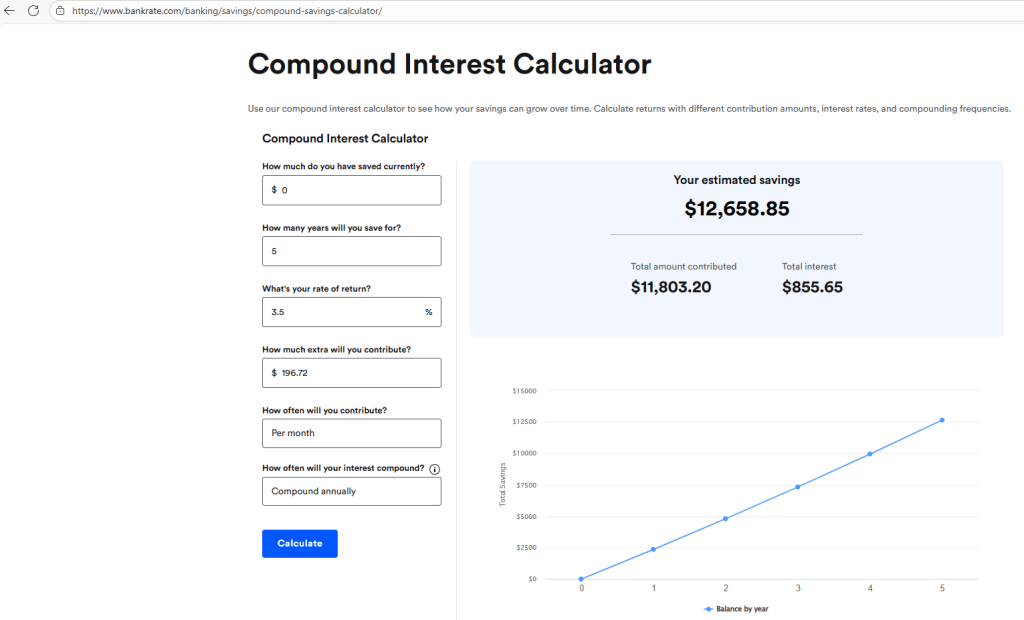

Now, let’s say that you took that savings of $196.72 and put it into a simple high-yield savings account every month with a 3.5% interest rate.

In 5 years, you could have over $12,000 in your savings account!

These numbers are estimates and provided for informational and entertainment purposes only, so please check your individual circumstances and independently verify your own numbers. All of these finance offers are subject to terms and conditions. Used for demonstration only.

Repair, Not Replace.

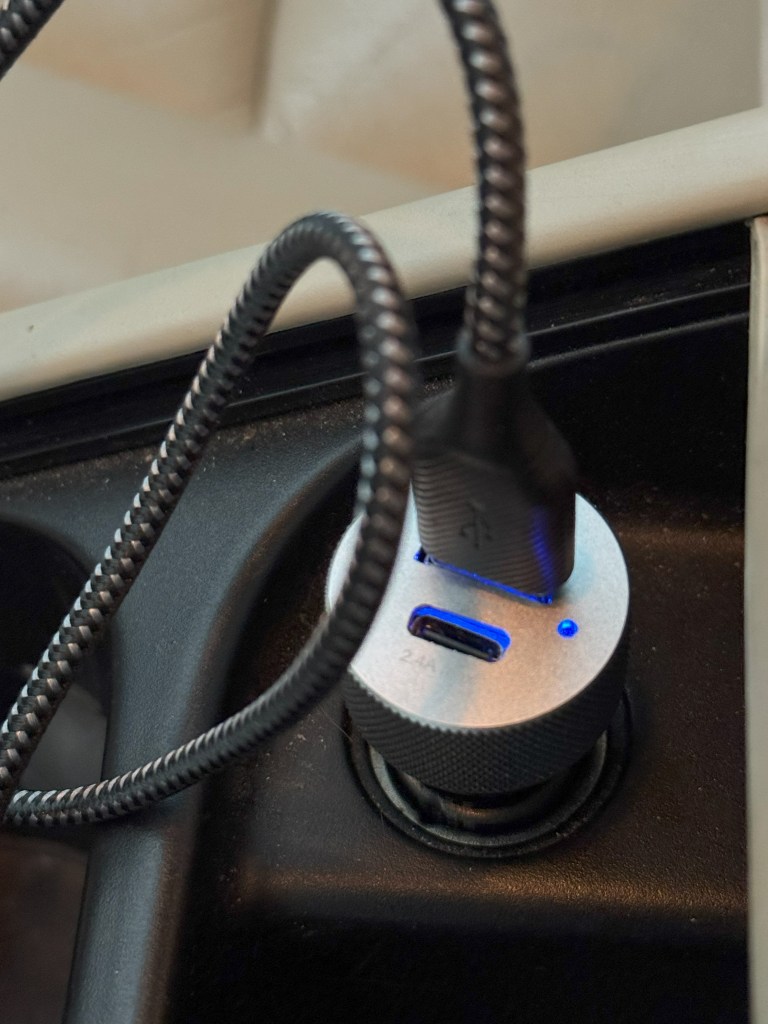

The best way to save money is by keeping the vehicle you already have. I had a small win with the Volvo this week.

Ever since we bought the vehicle in 2020, the 12V outlets in the center console didn’t work. A dime was stuck in the outlet, and I assumed the whole outlet needed replacement.

However, I decided to just give it a try this week. The coin was out of the outlet in about ten minutes.

But the outlet still didn’t work.

“Okay, let’s check the fuse,” I thought.

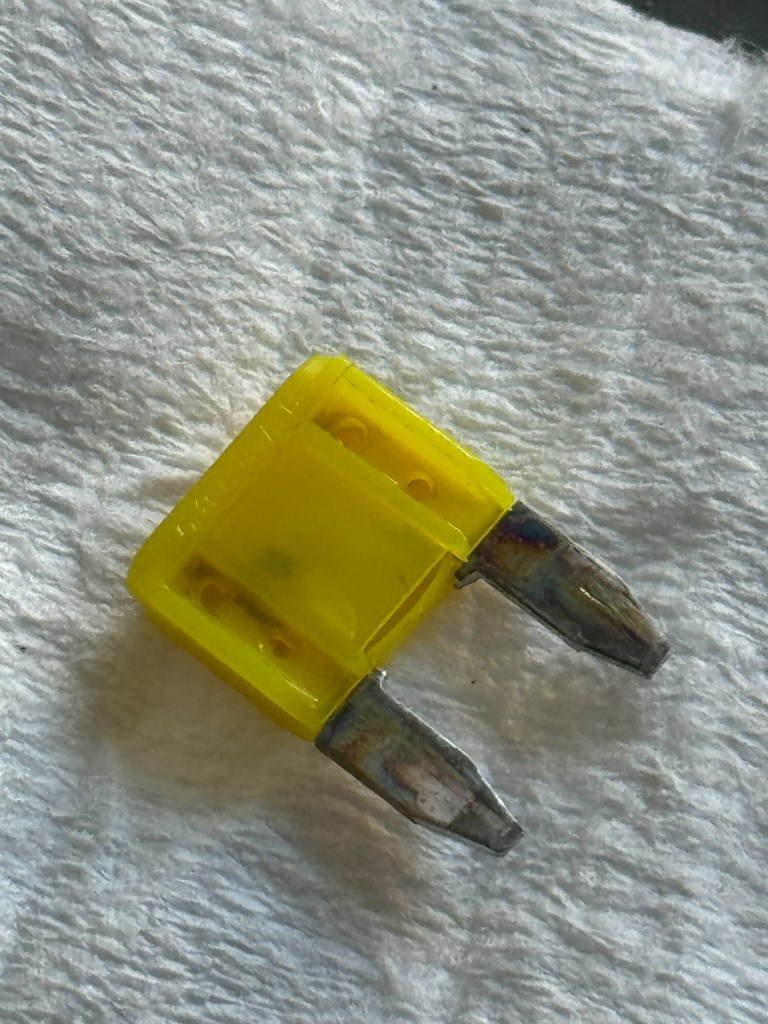

Sure enough, after reviewing the owner’s manual and pulling the fuse, I discovered the previous owner had clearly tried to replace the fuse, not seen the coin, and popped the fuse again. Weirdly enough, they used the wrong size fuse, too.

After $8 and a quick trip to Autozone, the outlet is working again.

Leave a comment